Used Car Sales Tax Colorado Springs . State of colorado, el paso county, and pprta. the following table is intended to provide basic information regarding the collection of sales and use tax and reflects rates currently in. the sales tax return (dr 0100) changed for the 2020 tax year and subsequent periods. colorado collects a 2.9% state sales tax rate on the purchase of all vehicles. in general, motor vehicle leases are considered retail sales and are subject to colorado sales tax. Motor vehicle dealerships, should review the. However, a county tax of up to 5% and a city or local tax. collected by the colorado department of revenue: This free online car sales tax. any motor vehicle purchased by a colorado springs resident must be registered at the address of the owner's primary residence. with the privateauto used car sales tax calculator, estimating sales tax has never been easier. However, a lease for a term of 36.

from www.templateroller.com

collected by the colorado department of revenue: However, a county tax of up to 5% and a city or local tax. with the privateauto used car sales tax calculator, estimating sales tax has never been easier. This free online car sales tax. Motor vehicle dealerships, should review the. the sales tax return (dr 0100) changed for the 2020 tax year and subsequent periods. State of colorado, el paso county, and pprta. any motor vehicle purchased by a colorado springs resident must be registered at the address of the owner's primary residence. the following table is intended to provide basic information regarding the collection of sales and use tax and reflects rates currently in. However, a lease for a term of 36.

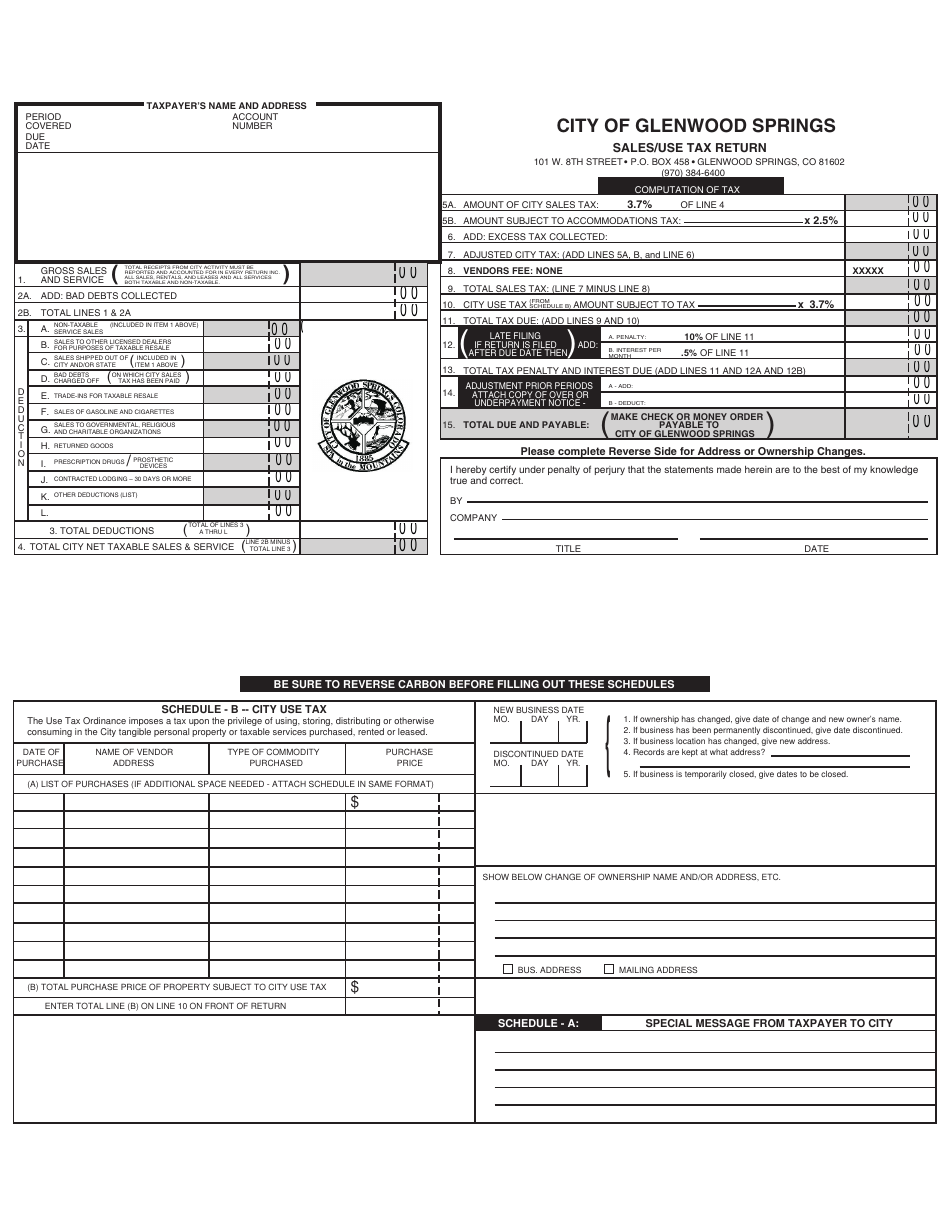

City of Glenwood Springs, Colorado Sales/Use Tax Return Form Fill Out, Sign Online and

Used Car Sales Tax Colorado Springs Motor vehicle dealerships, should review the. with the privateauto used car sales tax calculator, estimating sales tax has never been easier. However, a county tax of up to 5% and a city or local tax. collected by the colorado department of revenue: However, a lease for a term of 36. the following table is intended to provide basic information regarding the collection of sales and use tax and reflects rates currently in. State of colorado, el paso county, and pprta. in general, motor vehicle leases are considered retail sales and are subject to colorado sales tax. any motor vehicle purchased by a colorado springs resident must be registered at the address of the owner's primary residence. the sales tax return (dr 0100) changed for the 2020 tax year and subsequent periods. Motor vehicle dealerships, should review the. colorado collects a 2.9% state sales tax rate on the purchase of all vehicles. This free online car sales tax.

From cewqctjp.blob.core.windows.net

Iowa Used Car Sales Tax Calculator at Carl Ehrlich blog Used Car Sales Tax Colorado Springs colorado collects a 2.9% state sales tax rate on the purchase of all vehicles. any motor vehicle purchased by a colorado springs resident must be registered at the address of the owner's primary residence. with the privateauto used car sales tax calculator, estimating sales tax has never been easier. State of colorado, el paso county, and pprta.. Used Car Sales Tax Colorado Springs.

From autoapprove.com

Sales Tax When Buying A Used Car Your Ultimate Guide Used Car Sales Tax Colorado Springs colorado collects a 2.9% state sales tax rate on the purchase of all vehicles. in general, motor vehicle leases are considered retail sales and are subject to colorado sales tax. This free online car sales tax. However, a lease for a term of 36. State of colorado, el paso county, and pprta. collected by the colorado department. Used Car Sales Tax Colorado Springs.

From www.carmax.com

Used cars in Colorado Springs, CO for Sale Used Car Sales Tax Colorado Springs in general, motor vehicle leases are considered retail sales and are subject to colorado sales tax. collected by the colorado department of revenue: colorado collects a 2.9% state sales tax rate on the purchase of all vehicles. the sales tax return (dr 0100) changed for the 2020 tax year and subsequent periods. However, a county tax. Used Car Sales Tax Colorado Springs.

From www.templateroller.com

City of Steamboat Springs, Colorado Sales Tax Return Form Fill Out, Sign Online and Download Used Car Sales Tax Colorado Springs in general, motor vehicle leases are considered retail sales and are subject to colorado sales tax. the following table is intended to provide basic information regarding the collection of sales and use tax and reflects rates currently in. collected by the colorado department of revenue: This free online car sales tax. Motor vehicle dealerships, should review the.. Used Car Sales Tax Colorado Springs.

From www.templateroller.com

City of Glenwood Springs, Colorado Sales/Use Tax Return Form Fill Out, Sign Online and Used Car Sales Tax Colorado Springs However, a lease for a term of 36. collected by the colorado department of revenue: the following table is intended to provide basic information regarding the collection of sales and use tax and reflects rates currently in. However, a county tax of up to 5% and a city or local tax. with the privateauto used car sales. Used Car Sales Tax Colorado Springs.

From cexuigoy.blob.core.windows.net

Sales Tax On Used Car Purchase In California at John Claude blog Used Car Sales Tax Colorado Springs the sales tax return (dr 0100) changed for the 2020 tax year and subsequent periods. collected by the colorado department of revenue: Motor vehicle dealerships, should review the. the following table is intended to provide basic information regarding the collection of sales and use tax and reflects rates currently in. However, a lease for a term of. Used Car Sales Tax Colorado Springs.

From www.carsalerental.com

Car Sales Tax And Registration Fees Car Sale and Rentals Used Car Sales Tax Colorado Springs the sales tax return (dr 0100) changed for the 2020 tax year and subsequent periods. State of colorado, el paso county, and pprta. any motor vehicle purchased by a colorado springs resident must be registered at the address of the owner's primary residence. However, a lease for a term of 36. colorado collects a 2.9% state sales. Used Car Sales Tax Colorado Springs.

From www.carsalerental.com

What Is Car Sales Tax In Colorado Car Sale and Rentals Used Car Sales Tax Colorado Springs This free online car sales tax. any motor vehicle purchased by a colorado springs resident must be registered at the address of the owner's primary residence. in general, motor vehicle leases are considered retail sales and are subject to colorado sales tax. collected by the colorado department of revenue: However, a lease for a term of 36.. Used Car Sales Tax Colorado Springs.

From www.carsalerental.com

How To Figure Sales Tax On A Car Car Sale and Rentals Used Car Sales Tax Colorado Springs collected by the colorado department of revenue: any motor vehicle purchased by a colorado springs resident must be registered at the address of the owner's primary residence. Motor vehicle dealerships, should review the. This free online car sales tax. colorado collects a 2.9% state sales tax rate on the purchase of all vehicles. However, a county tax. Used Car Sales Tax Colorado Springs.

From motobyo.com

Used Car Sales Tax Laws in Pennsylvania Motobyo Used Car Sales Tax Colorado Springs However, a county tax of up to 5% and a city or local tax. State of colorado, el paso county, and pprta. in general, motor vehicle leases are considered retail sales and are subject to colorado sales tax. the sales tax return (dr 0100) changed for the 2020 tax year and subsequent periods. with the privateauto used. Used Car Sales Tax Colorado Springs.

From www.templateroller.com

Form DR0024 Download Fillable PDF or Fill Online Standard Sales Tax Receipt for Vehicle Sales Used Car Sales Tax Colorado Springs However, a lease for a term of 36. colorado collects a 2.9% state sales tax rate on the purchase of all vehicles. However, a county tax of up to 5% and a city or local tax. any motor vehicle purchased by a colorado springs resident must be registered at the address of the owner's primary residence. with. Used Car Sales Tax Colorado Springs.

From www.exemptform.com

Resale Exemption Certificate City Of Colorado Springs Sales Tax Used Car Sales Tax Colorado Springs This free online car sales tax. with the privateauto used car sales tax calculator, estimating sales tax has never been easier. Motor vehicle dealerships, should review the. colorado collects a 2.9% state sales tax rate on the purchase of all vehicles. collected by the colorado department of revenue: in general, motor vehicle leases are considered retail. Used Car Sales Tax Colorado Springs.

From legaltemplates.net

Free Colorado Bill of Sale Forms PDF & Word Used Car Sales Tax Colorado Springs colorado collects a 2.9% state sales tax rate on the purchase of all vehicles. However, a lease for a term of 36. the sales tax return (dr 0100) changed for the 2020 tax year and subsequent periods. collected by the colorado department of revenue: This free online car sales tax. Motor vehicle dealerships, should review the. . Used Car Sales Tax Colorado Springs.

From www.faricy.com

Used Cars Colorado Springs, CO Used Car Sales Tax Colorado Springs with the privateauto used car sales tax calculator, estimating sales tax has never been easier. However, a lease for a term of 36. the sales tax return (dr 0100) changed for the 2020 tax year and subsequent periods. This free online car sales tax. in general, motor vehicle leases are considered retail sales and are subject to. Used Car Sales Tax Colorado Springs.

From www.templateroller.com

City of Colorado Springs, Colorado 3.12 Sales and Use Tax Return Fill Out, Sign Online and Used Car Sales Tax Colorado Springs collected by the colorado department of revenue: the following table is intended to provide basic information regarding the collection of sales and use tax and reflects rates currently in. Motor vehicle dealerships, should review the. However, a lease for a term of 36. with the privateauto used car sales tax calculator, estimating sales tax has never been. Used Car Sales Tax Colorado Springs.

From islandstaxinformation.blogspot.com

Colorado Springs Sales Tax Calculator Used Car Sales Tax Colorado Springs colorado collects a 2.9% state sales tax rate on the purchase of all vehicles. collected by the colorado department of revenue: the following table is intended to provide basic information regarding the collection of sales and use tax and reflects rates currently in. in general, motor vehicle leases are considered retail sales and are subject to. Used Car Sales Tax Colorado Springs.

From www.carsalerental.com

How Much Is Used Car Sales Tax In Illinois Car Sale and Rentals Used Car Sales Tax Colorado Springs any motor vehicle purchased by a colorado springs resident must be registered at the address of the owner's primary residence. Motor vehicle dealerships, should review the. This free online car sales tax. in general, motor vehicle leases are considered retail sales and are subject to colorado sales tax. with the privateauto used car sales tax calculator, estimating. Used Car Sales Tax Colorado Springs.

From www.motorbiscuit.com

5 States With 0 Sales Tax on New and Used Car Sales Used Car Sales Tax Colorado Springs collected by the colorado department of revenue: Motor vehicle dealerships, should review the. with the privateauto used car sales tax calculator, estimating sales tax has never been easier. This free online car sales tax. any motor vehicle purchased by a colorado springs resident must be registered at the address of the owner's primary residence. in general,. Used Car Sales Tax Colorado Springs.